Glovo Shifts Gears: 15K Spanish Riders Go Full-Time. Here's What Happens Next

Glovo's decision to turn its freelance riders into employees may be a game changer for the company and the industry.

Joining Glovo's delivery army is easy. Fill out a form, go through the mandatory checks and pick up your bright yellow thermal bag. Whether you drive, ride a bike or simply walk, you'll be in good company.

In Spain, Glovo has 15K riders who operate under the Spanish autonomo (freelancer) tax status. This means that Glovo technically doesn't employ its delivery force and doesn't have to pay social security required by Spanish law.

This is about to change.

Recently, Glovo announced that it will extend formal employment contracts to its delivery force in Spain. It’s not an act of generosity but of need.

Losing a series of court disputes and facing solid fines for violating Spanish labour laws, Glovo has determined it would be cheaper to simply hire its riders.

Glovo’s leadership must not have made this decision lightly. It comes with a series of ripple effects across every corner of the company. It sets a precedent for Glovo's subsidiaries in other countries and its competitors.

Below we explore some likely implications through the lens of finance and strategy.

But before we start:

I don't have any affiliations with Glovo and rely only on public information for this analysis.

Brace yourself for some dense reading. This article goes fairly deep and technical on Glovo’s pricing and cost structure.

None of this is investment advice.

The Company

Delivery Hero (DHER), Glovo's owner, has already reported an Є100M impact on its 2025 adjusted EBITDA. It's not clear how much of this amount will be attributable to operating expenses and how much to one-time adjustments. To complicate things further, we don't know what portion of the operating expenses will be recurring vs one-time hits.

If the majority of the Є100M goes to EBITDA adjustments, like non-compliance penalties, then the long-term operating profitability should stay on track. Chances are, the operating model and margins won't require any major rethinking. It's business as usual.

On the other hand, if most of the Є100M affect operations, then we can expect a long-term impact on profitability margins and cash flows. Glovo’s management will be pressured to do something to offset the impact and preserve the margins.

In this case, I think the Є100M impact goes to continuous operations and one-time adjustments. Adding 15K employees to payroll is no minor blip even for large companies.

But what is an adjusted EBITDA?

EBITDA is essentially the operating income before taking into account depreciation, interest, and taxes. It's common for companies to incur expenses (or income) related to one-time non-operating activities. Common examples are the proceeds from a sale of an asset, legal settlement payments, and acquisition expenses.

These non-operating expenses (or income) are usually reported below the EBITDA line on the P&L. Because they are considered adjustments to EBITDA, it's common to calculate an adjusted EBITDA.

Adjusted EBITDA helps bridge the gap between the operating income and net income. In practice, however, it's a bullshit metric when it comes to measuring performance. You can't use it to tell how the company did in the current year and you can't use it to glean how the company will do in the future. Adjusted EBITDA includes a whole bunch of randomness that has nothing to do with operations and is not likely to repeat in the same way in the future.

Adjusted EBITDA aside, switching 15K freelancers to employees drives bigger structural changes at the company

Delivery Hero breaks down its revenue model like this:

It's fair to assume Glovo's model will be more or less the same.

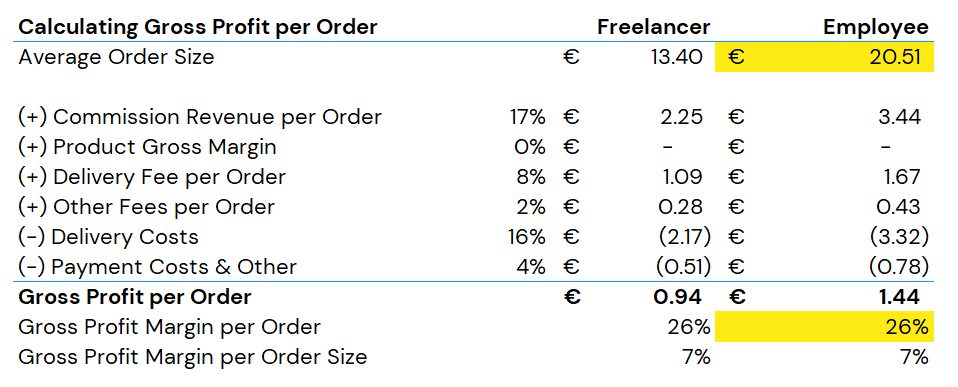

Using the average order size of Є13.4, the company pays Є2.17 (16%) in delivery costs per order. Its revenue per order of average size is Є3.62. The delivery costs make up 60% of the revenue per order.

These fees are calculated as percentages, so the bigger the order size, the higher the fees.

Delivery riders also receive tips of which they likely keep at 100%.

As Glovo switches from the freelancers to employees, the structure of the delivery costs is going to change. It will switch from variable to fixed. This could be good or bad for the company depending on how the numbers shake out.

Let's walk through a hypothetical example.

Calculating the cost of a freelancer

Under the current model, Glovo hires freelances to do its deliveries. The company pays a freelancer about Є13,500 per year. Here's how I calculated this number:

From Delivery Hero's data we know that the average delivery cost per order is Є2.17. This fee is calculated as a percentage, so we have to keep in mind that this number is based on the average order price of Є13.40, which also comes from Delivery Hero.

I did some search on the number of orders a rider usually delivers in a day. It's about 24.

If the average rider works regular eight-hour days and takes the weekends off, then she will work 260 days per year. Of course, it's normal for riders to take time off but any such days are offset by the fact that many riders actually work on the weekends, which I'm not counting here.

So, we know the work days in a year and the orders per day. We multiply the two and we get the orders delivered by the average rider in a year: 6,240. We multiply this number by the delivery cost and we get the cost of hiring a freelancer: Є13,541.

How does this compare to the cost of hiring an employee?

The cost of hiring an employee

I've estimated the cost of hiring a full time employee will be about Є21,000. Here's my calculation:

As of this writing the minimum annual wage for a full-time employee in Spain is Є15,876.

On top of this number, the company has to pay for various employment contributions, which on average add up to about 30.5% or Є4,842 per year. When we gross up the base of Є15,876 with 30.5% contributions we get a total cost to the employer of Є20,718.

The cost of an employee of Є20,718 is much higher than the cost of the freelancer of Є13,541. Naturally, if Glovo swaps the freelancers for employees its delivery cost will go up, but by how much?

Delivery costs: freelancers vs. employees

We can reverse-calculate the delivery cost per order using the information we already have. By swapping the freelancer cost (Є13,541) with the employee cost (Є20,718), the delivery cost per order shoots up from Є2.17 to Є3.32 (+53%).

If Glovo wants to keep its delivery cost the same, it has to get its deliveries 53% higher. Is this feasible? Likely not, unless the company changes how deliveries are being done. The company already dominates the market, so the opportunity for organic growth in existing markets is limited.

While the impact of the change from freelancers to employees is obvious, to fully appreciate the effect, we need to zoom out and look at the overall unit economics of an order.

Gross profit per order: freelancers vs. employees

The only difference in the inputs is the delivery cost. It has a major impact on the gross profit, which calls for rethinking of the whole fee structure.

The big question is what can Glovo do next to turn the gross profit from a negative to positive?

To fully grasp our options, we have to understand the interconnections between the different components of the revenue model. At its core any model is a system of interdependent components. Understanding the relationships between these components will help us understand the ripple effects of the changes we want to make.

In this case, we know that the fees that comprise the revenue and the delivery costs are percentages of the average order size. Under the freelancer model, if we increase the average order size, the revenue and delivery fees will go up proportionately. Thus, the gross margin per order will stay the same.

Side note: I'm assuming the relationships between average cost size, the various fees and delivery costs are linear. Where we might see some deviation from this linearity in the payment costs, which if we assume they include payment processing fees, likely include fixed costs along with the percentage-based fees.

Under the employee scenario, however, the delivery costs are no longer percentages of the order size. They are based on fixed salaries and the average number of deliveries in the year. This means that if we increase the average order size, we can increase the revenue without also driving a proportionate increase in the delivery cost.

We can easily figure out what the average order size needs to be in order to preserve the gross profit margins:

The question is: what can we do to increase the average order size? The starting point is accepting that the company doesn't have full control over this piece. At the same time, Glovo can design its product in a way that nudges its customers to buy more. This is where product and finance play together to solve a critical business problem.

The average order size is just one of the levers Glovo can pull to compensate for the higher delivery costs. Increasing the commission percentage from 17% to 28% will get us to the target margin without putting pressure on the average order size. The problem is that getting just this one rate that high will most likely have an effect on the business partner retention. While Glovo has 100% control over the commission percentage, there are limits of how much they can hike it up.

Usually, the optimal solution calls for pulling all levers at our disposal just enough to get us the desired outcome without triggering adverse ripple effects.

Below is one scenario where we pull several levers "just enough" to get the target outcome.

The risk lies in how much "just enough" is. Determining these tipping points is a collaborative effort between product, sales and finance. Making the right call requires deep systems thinking not just at a company level but a market level too. It’s a collaborative effort. It’s a myth that a Musk-like CEO makes such decisions single-handedly relying on gut and innate genius.

It's not just the money

Keep reading with a 7-day free trial

Subscribe to destructured to keep reading this post and get 7 days of free access to the full post archives.